Rex proves airlines don’t have to rip you off with surcharges

Take note, Qantas and Virgin and Jetstar and Tigerair.

I flew regional airline Rex for the first time over the weekend. One thing I learned as a result is that Grafton Airport might kindly be described as rudimentary. Another was that Rex has a much more sensible approach to credit card surcharges than its larger rivals.

As we’ve reported previously, from September airlines and other big businesses won't be allowed to charge a fixed fee when you use a credit card to pay. Instead, they'll only be permitted to charge a percentage of the total cost, since that's a more accurate reflection of how they're charged by the banks. Surcharges aren't supposed to be a profit centre for airlines, but the fact that the Reserve Bank had to step in to enforce the law suggests that they have been up until now.

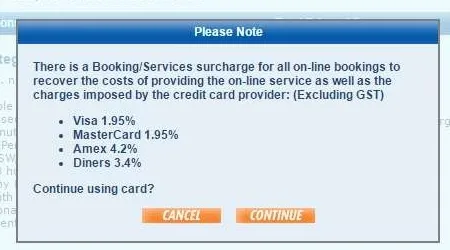

While Qantas and Virgin (and their budget brands Jetstar and Tigerair) have been dragging their heels, Rex already uses this approach. The credit card surcharge is 1.95% of the total for Visa or Mastercard, 3.4% for Diners Club (apparently still a thing) and 4.2% for American Express. For my fare, that came to $2.76, which is much more reasonable than the $8 or so every other domestic airline slugs you with.

As September approaches, we can expect to see changes from all airlines. Tigerair has already introduced the option of paying with PayPal, which has a lower fee. But the Rex example shows that it's not impossible to move to the percentage approach. I hope some of the other airlines follow suit.

Angus Kidman's Findings column looks at new developments and research that help you save money, make wise decisions and enjoy your life more. It appears Monday through Friday on finder.com.au.